As we all may remember, the tech boom and bust at the turn of the century was the result of “life-changing” technology combined with rampant speculation. The analogies between the dot com period and now are becoming more obvious. The comparison is instructive because the capital flows going into technology (as measured by CAPEX) swamped nearly everything else in the economy. Once investor capital fled (perhaps “disappeared” is a more appropriate description), investment in CAPEX dried up as returns remained flat over the next 15 years.

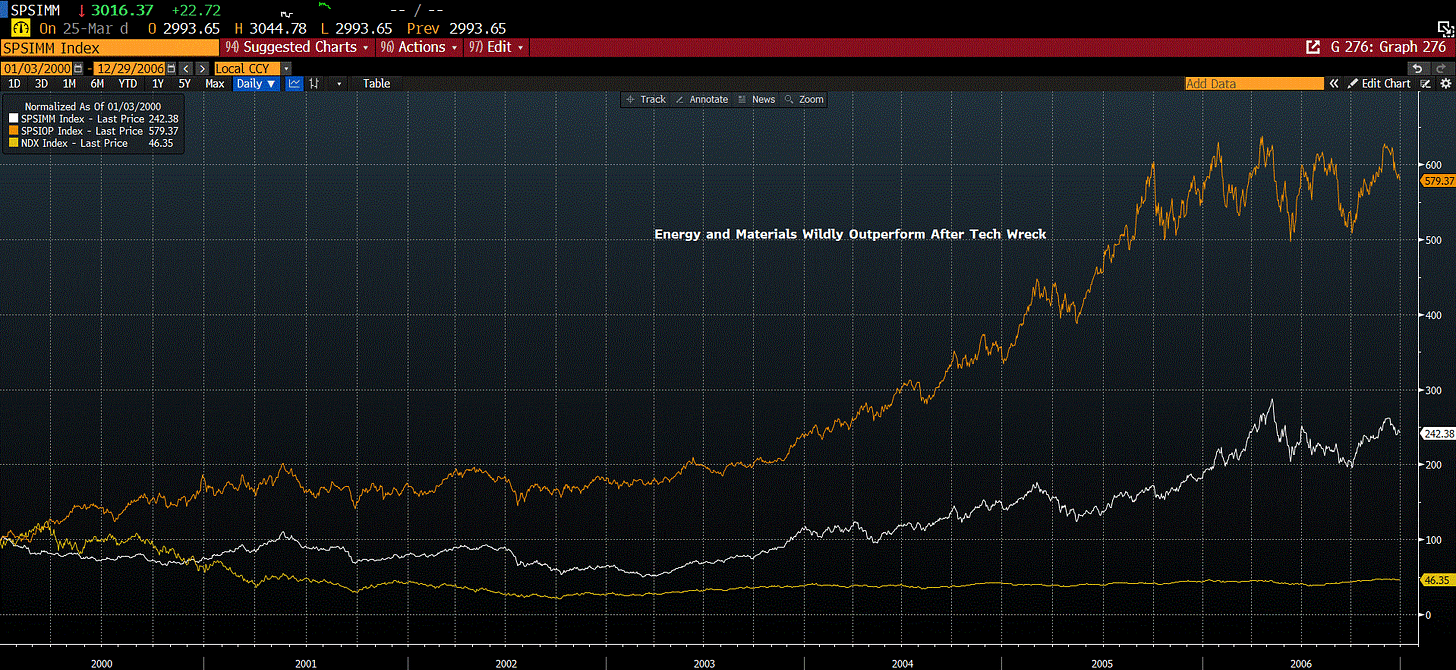

The flip side of that rotation involved the energy and materials sectors. Here, you had a dearth of CAPEX for the five years leading up to the bursting of the tech bubble in 2000. Unlike technology, however, declines in CAPEX in the natural resource world show up almost immediately as constrained supply. This, in turn, fuels the next up cycle in earnings and pricing power. This is exactly what we saw coming out of the early 2000 period (see graph above). During this period, demand simply had to stay constant for producers to benefit as supply was so CAPEX constrained. This was key as the U.S. economy experienced a recession in 2002-03.

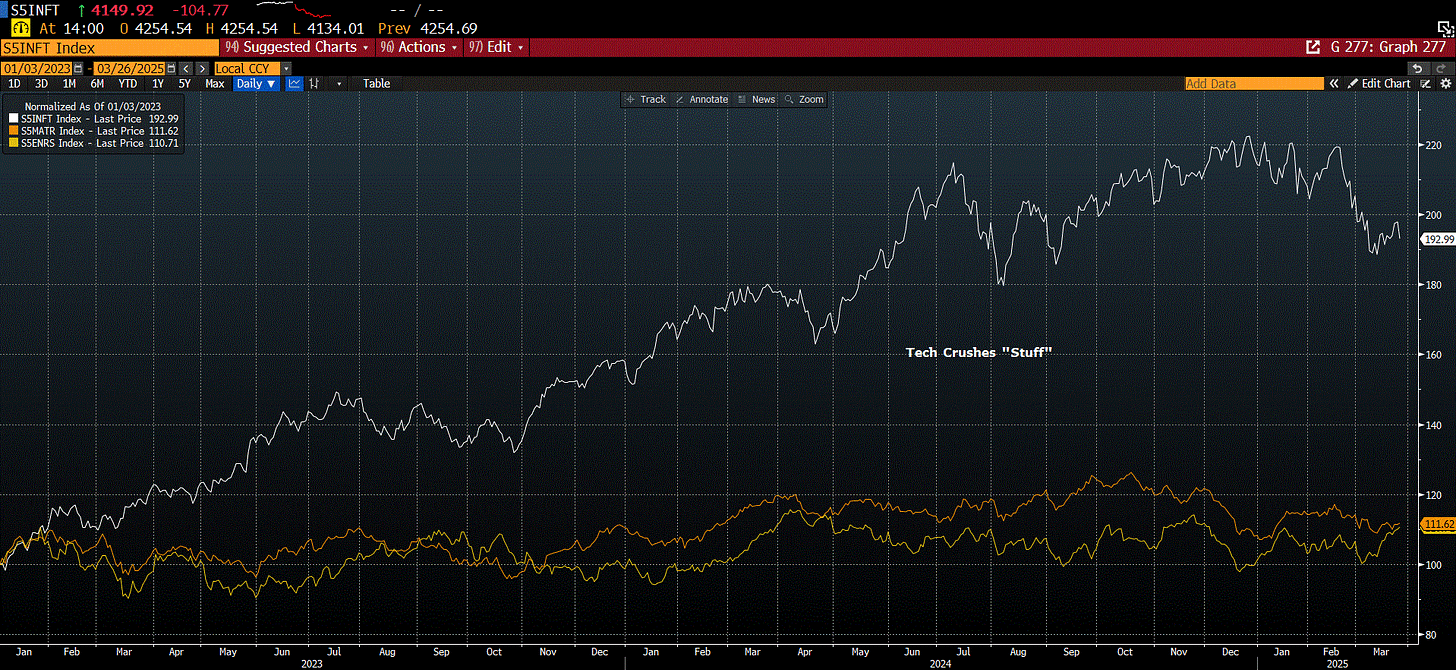

Fast forward to the new potential bubble we are currently experiencing in AI and its associated technology. While you may argue about the relative importance or monetization of the technology, you are seeing the exact same relative valuation and outperformance in technology vs. natural resources/commodities that we witnessed back then. Again, this has been partially driven by a lack of investor interest as well as decremental CAPEX spend.

While the outperformance of the MAG 7 may have begun to roll over, the very foundation for this outperformance was pierced in January when the existence of a Chinese Firm (DeepSeek) called into question the need for multi-tens of billions in new AI-related spending. If we experience a general slowdown in the economy, combined with a realization that the transformational nature of AI is years down the road, we fully expect to see a similar rotation away from technology and into natural resources/commodities take place. This shift will be further reinforced by a geo-political environment that is causing a land grab for strategically important commodities.

Takeaways: The massive outperformance of technology vs. the broader markets is being unwound, and if past is prologue, (and we think it is) the direct beneficiary of this shift will be the materials/commodities sectors. The relative underperformance of “stuff” versus tech over the last four years directly mirrors the market environment leading up to the tech wreck in 2000. Those investors that rotated out of technology and into materials and energy in early 2000 saw significant gains over the next five years, even though this period contained a recession.

Do you guys have a linkedin? Love the material.